Lifetime Gift And Estate Tax Exemption 2024 Nj. Starting on january 1, 2024, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023). The tax cuts and jobs act delivered a sizable increase in the tax exemption limit for estates and lifetime gifts — up to $13.61 million per person in 2024.

This limit is called the lifetime, or combined, gift and estate tax exemption. This threshold doubled from $5 million to $10.

This Means That You Can Give Up To $13.61 Million In Gifts Throughout Your Life Without Ever Having To Pay Gift Tax On.

This threshold doubled from $5 million to $10.

In Fact, You Also Have A Lifetime Gift Exemption Amount, Which Is The Same Amount As The Federal Estate Tax Exemption Amount ($13.61 Million In 2024).

The federal gift tax applies to gifts of more than $18,000 in 2024 and $17,000 in 2023.

Lifetime Gift And Estate Tax Exemption 2024 Nj Images References :

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2024 Nancy Valerie, A married couple filing jointly can double this amount and gift. The federal gift tax applies to gifts of more than $18,000 in 2024 and $17,000 in 2023.

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2024 Nancy Valerie, A married couple filing jointly can double this amount and gift. Because it’s linked to the federal estate tax exemption, it, too, is set to increase in 2024.

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2024 Nancy Valerie, This threshold doubled from $5 million to $10. In order to trigger a bill, you’d need to breach the lifetime gift and estate tax exemption, which is $13.61 million for 2024 ($27.22 million for married couples) and $12.92 million for 2023 ($25.84 million for.

Source: mashaqjulina.pages.dev

Source: mashaqjulina.pages.dev

2024 Estate Tax Exemption Irs Andra Blanche, By gifting assets before death, you can take advantage of your annual and lifetime gift exemptions to reduce your estate’s taxable value and allow. Because it’s linked to the federal estate tax exemption, it, too, is set to increase in 2024.

Source: www.carboncollective.co

Source: www.carboncollective.co

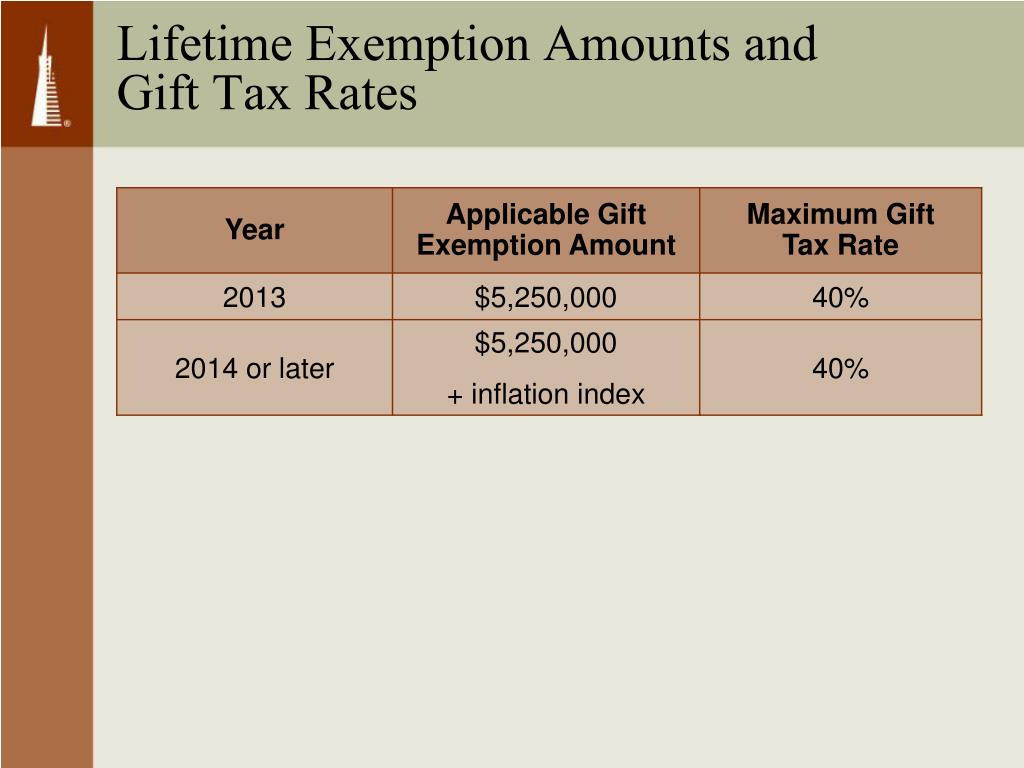

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, Each individual has a federal estate and gift tax exemption. In fact, you also have a lifetime gift exemption amount, which is the same amount as the federal estate tax exemption amount ($13.61 million in 2024).

Source: www.youtube.com

Source: www.youtube.com

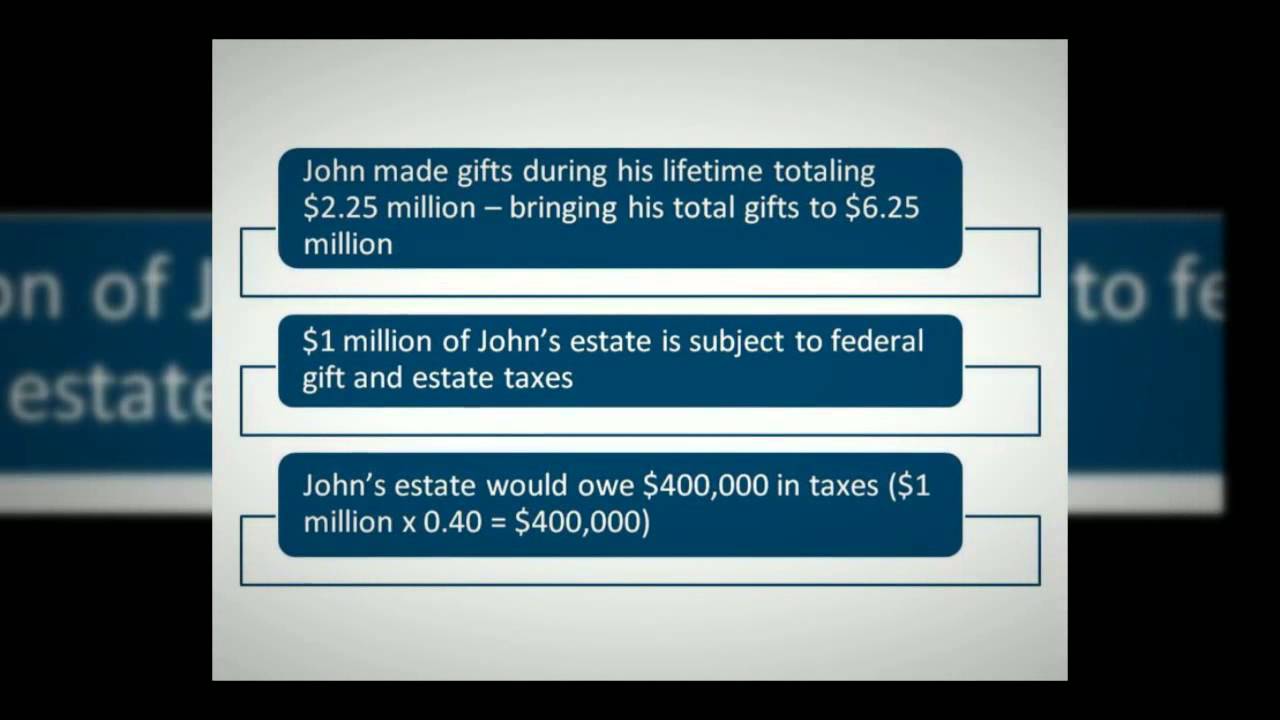

The Lifetime Exemption to Gift and Estate Taxes YouTube, For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023. This limit is called the lifetime, or combined, gift and estate tax exemption.

Source: teenaqwalliw.pages.dev

Source: teenaqwalliw.pages.dev

Lifetime Gift Tax Exemption 2024 Shirl Marielle, This means that an individual can make a certain amount of gratuitous transfers during life and/or at death without. In fact, you also have a lifetime gift exemption amount, which is the same amount as the federal estate tax exemption amount ($13.61 million in 2024).

Source: www.carboncollective.co

Source: www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, The 2024 lifetime federal gift and estate tax exemption update brings significant changes that can impact your estate planning strategy. Starting on january 1, 2024, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023).

Source: imagetou.com

Source: imagetou.com

Annual Gifting For 2024 Image to u, “gifts in excess of the annual exclusion will reduce the donor’s lifetime unified gift/estate tax exemption — $12.,060 million in 2022 — by the amount in excess. The annual gift tax exclusion for 2024 is now $18,000.00 per donor (the person making the gift) to any individual for the within calendar year;

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png) Source: arlenaqjenica.pages.dev

Source: arlenaqjenica.pages.dev

2024 Estate Tax Exemption Dana Milena, This limit is called the lifetime, or combined, gift and estate tax exemption. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on.

In New Jersey, The Inheritance Tax Was A Credit Against The Estate Tax;

Each individual has a federal estate and gift tax exemption.

The Annual Gift Tax Exclusion For 2024 Is Now $18,000.00 Per Donor (The Person Making The Gift) To Any Individual For The Within Calendar Year;

For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.