What Is The Medicare Deduction From Social Security For 2024. Social security and medicare taxes; Here’s what happened after cms officials considered the social security cola announcement and set the 2024 premiums, deductibles and other parameters for.

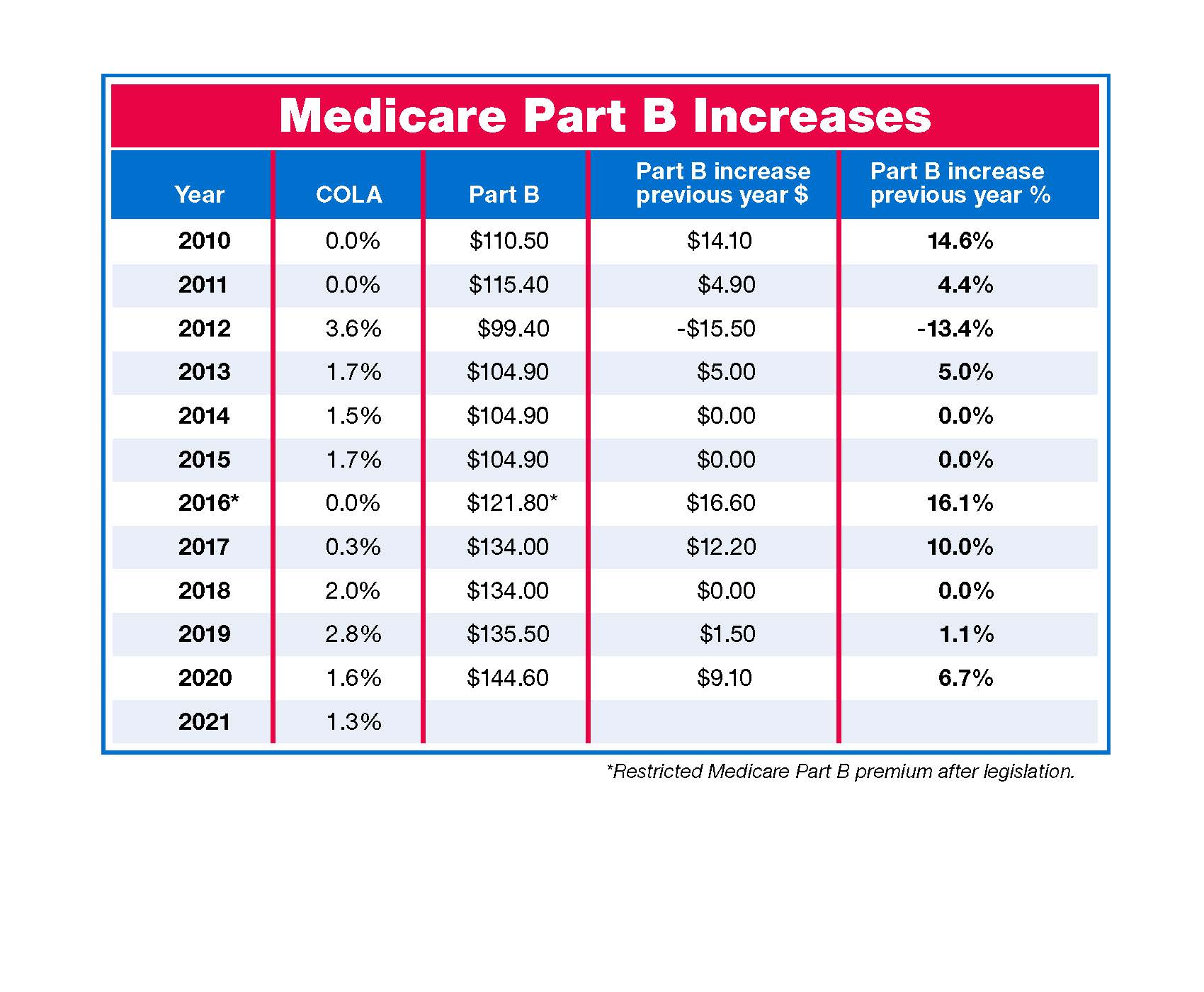

The annual deductible for all medicare part b beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible of $226 in 2023. Social security and medicare taxes;

How Social Security Determines You Have A Higher Premium.

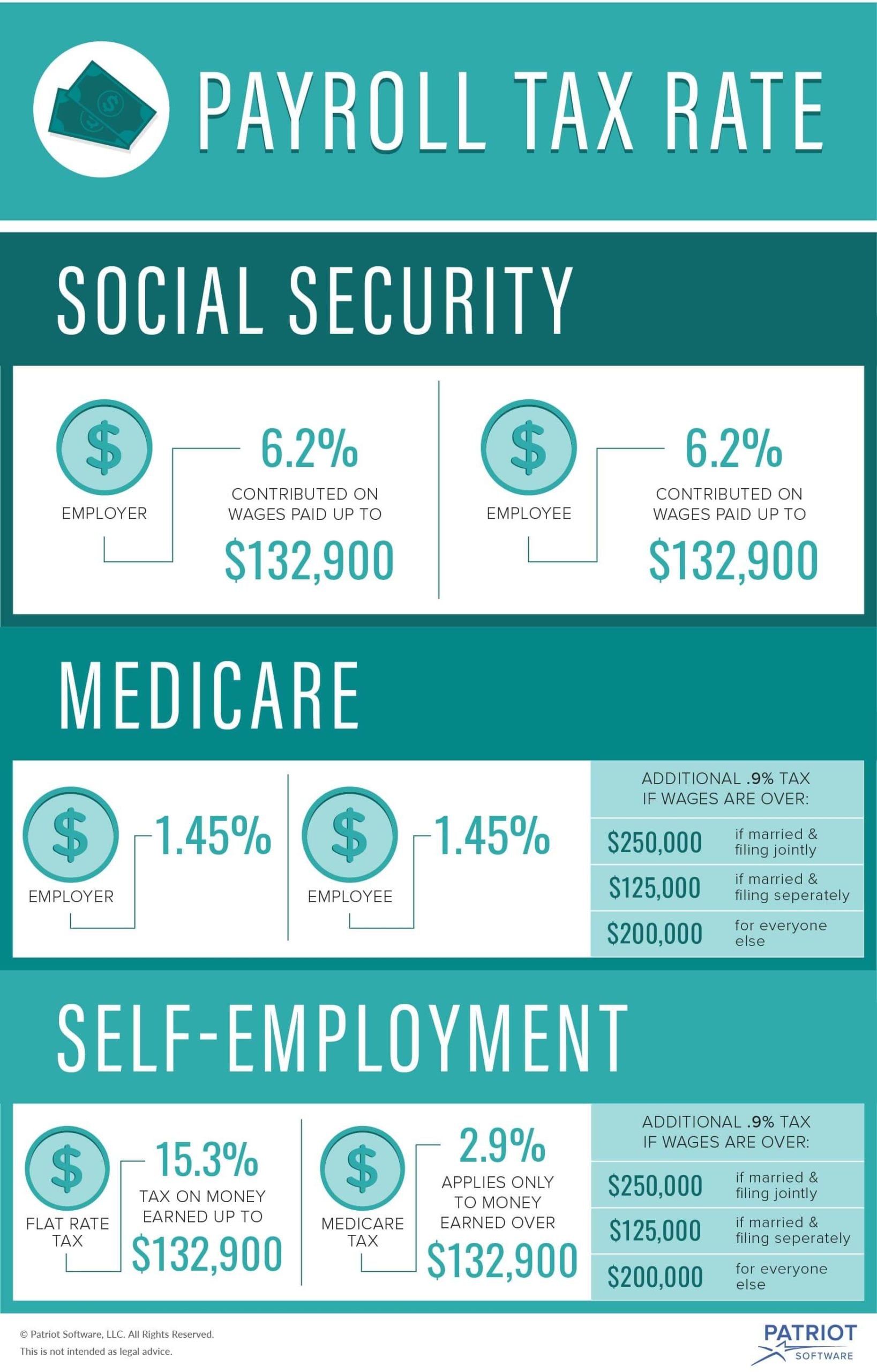

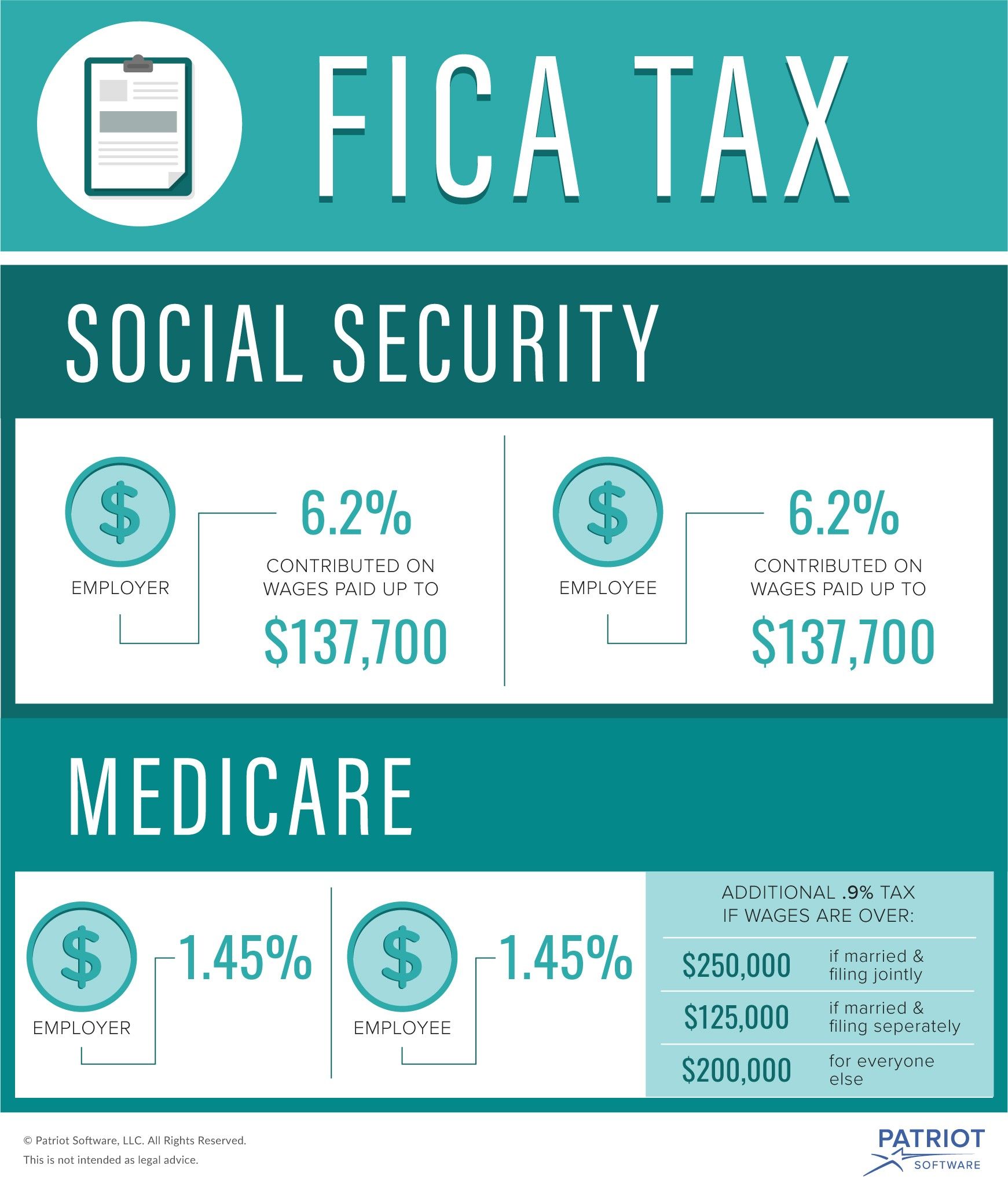

Social security —for active employees, the 6.2.

Medicare Advantage Deductibles, Part D.

In fact, if you are signed up for both social security and medicare part b — the portion of medicare that provides standard health insurance — the social security.

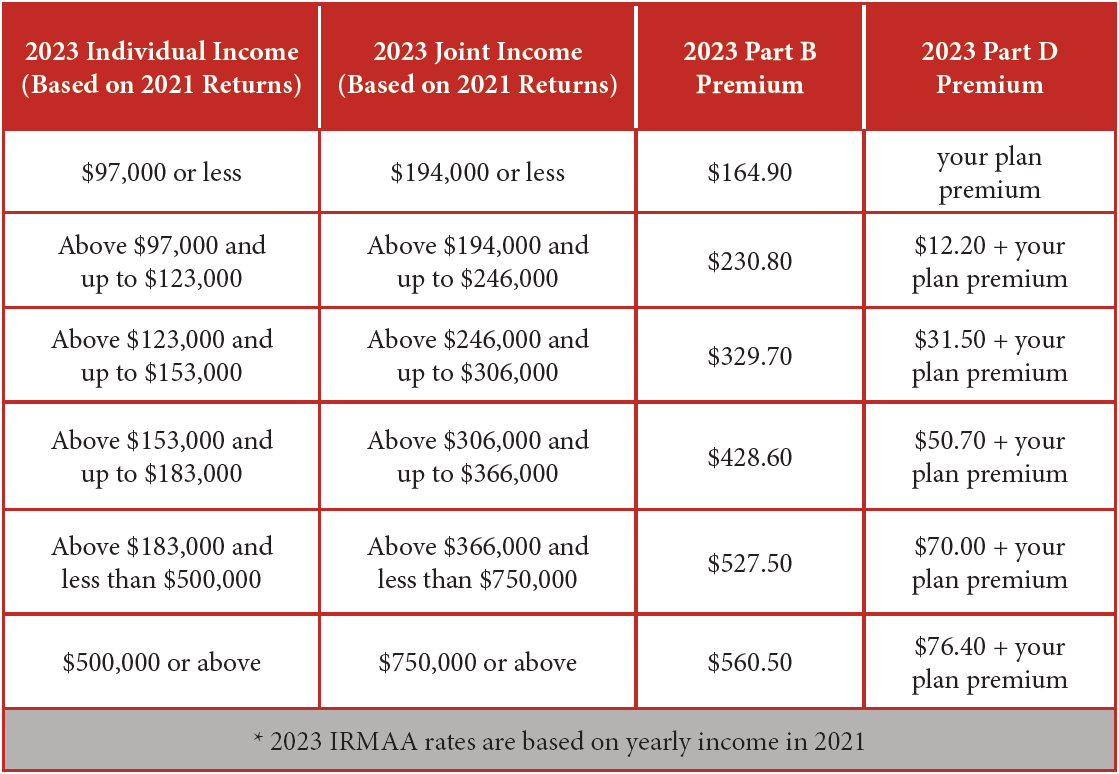

If You Have A Higher Income.

Images References :

Source: eligibility.com

Source: eligibility.com

How Medicare and Social Security Work Together Eligibility, On january 19, 2024, jeremy applied for the subsidy. Jeremy lives alone and receives $1,300 per month in social security benefits before the medicare part b.

Source: maricewcaren.pages.dev

Source: maricewcaren.pages.dev

What Is The Cost Of Medicare Part B For 2024 Dru Sharline, Medicare premiums are tax deductible; What is new in the 2024 social security and medicare report?

Source: www.medicaretalk.net

Source: www.medicaretalk.net

What Is Medicare Deduction From Social Security Check, The annual deductible for all medicare part b beneficiaries will be $240 in 2024, which is $14 more than the 2023 deductible of $226. However, they are not typically considered pretax, so they’re taken out of your paycheck based on the amount you.

Source: graceagency.org

Source: graceagency.org

How do Medicare and Social Security Work Together? Grace Agency, That deduction will be $1 for every $3 earned over a higher limit — $59,520. What is new in the 2024 social security and medicare report?

Source: eligibility.com

Source: eligibility.com

How Medicare and Social Security Work Together Eligibility, The maximum part d deductible for 2024 is $545 per year (though some plans waive the deductible completely). The annual deductible for all medicare part b beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible of $226 in 2023.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Is The Social Security And Medicare Tax Rate, Medicare advantage deductibles, part d. The standard monthly premium for medicare part b enrollees will be $174.70 for 2024, an increase of $9.80.

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Deduct Social Security Tax And Medicare Tax, If your income has gone down. Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

Source: raslaqnikkie.pages.dev

Source: raslaqnikkie.pages.dev

Irmaa Tables For 2024 Maura Nannie, Residents enrolled in original medicare (part a and part b) or a medicare advantage plan will pay a standard part b monthly premium. Medicare advantage deductibles, part d.

Source: www.nytimes.com

Source: www.nytimes.com

New Medicare Cards Are Being Issued. Here’s What You Need to Know, In fact, if you are signed up for both social security and medicare part b — the portion of medicare that provides standard health insurance — the social security. This reflects a $9.80 per month increase from the premium amount in 2023.

Source: www.acnb.com

Source: www.acnb.com

Social Security and Medicare Face Financial Challenges ACNB Bank, What is new in the 2024 social security and medicare report? How to calculate federal social security and medicare taxes, most medicare enrollees have paid enough payroll taxes to get medicare part a coverage.

How To Calculate Federal Social Security And Medicare Taxes, Most Medicare Enrollees Have Paid Enough Payroll Taxes To Get Medicare Part A Coverage.

How social security determines you have a higher premium.

Residents Enrolled In Original Medicare (Part A And Part B) Or A Medicare Advantage Plan Will Pay A Standard Part B Monthly Premium.

On january 19, 2024, jeremy applied for the subsidy.